The transaction is intended to add more than $1bn in net cash to Revolution Medicines’ balance sheet and increase Revolution’s efforts to discover, develop and deliver RAS(ON) Inhibitor drugs

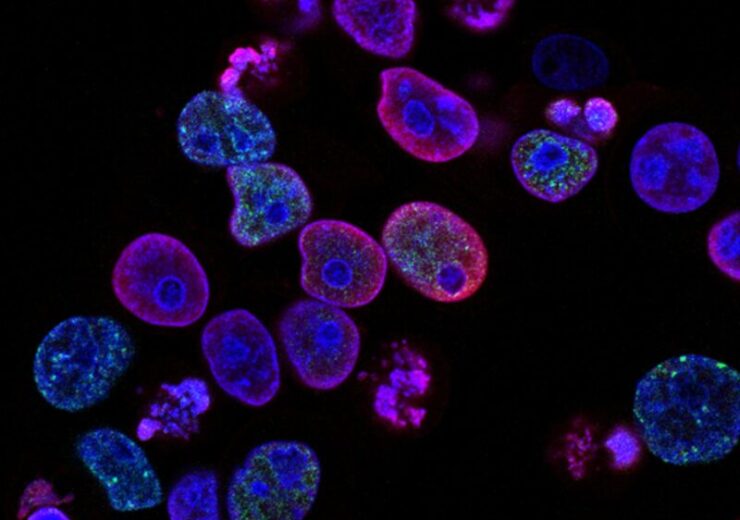

Revolution to buy EQRx to discover, develop and deliver RAS(ON) Inhibitor drugs for patients with RAS-addicted cancers. (Credit: National Cancer Institute on Unsplash)

Revolution Medicines, engaged in the development of targeted therapies for RAS-addicted cancers, has forged an agreement to acquire US drugmaker EQRx in an all-stock transaction.

The transaction is intended to add more than $1bn in net cash to Revolution Medicines’ balance sheet.

It will also increase the Revolution Medicines’ efforts to discover, develop and deliver RAS(ON) Inhibitor drugs for patients with RAS-addicted cancers.

The proposed transaction aims to support and maintain the oncology company’s parallel development strategy for its large RAS(ON) Inhibitor pipeline in a variety of RAS-driven malignancies by improving its balance sheet and boosting financial certainty.

Revolution is planning to start one or more single-agent clinical trials in 2024 based on the favourable data patterns for the RASMULTI(ON) Inhibitor RMC-6236.

Similarly, planning is underway for a Phase 1/1b trial to test the combination of RMC-6236 and KRASG12C(ON) Inhibitor RMC-6291, with a projected start date of early 2024.

Separately, the company will continue its single-agent assessment of the RMC-6291.

The latest deal of EQRx acquisition is based on the confidence in Revolution Medicines’ capacity to use this amount of capital efficiently.

Revolution Medicines CEO and chairman Mark Goldsmith said: “This deal marks a decisive step toward advancing Revolution Medicines’ vision as a self-sufficient organisation that discovers and develops highly innovative drug candidates with the goal of delivering high-impact targeted medicines into oncology practice on behalf of patients with RAS-addicted cancers.”

As per the terms of the deal, Revolution Medicines will acquire EQRx using the stock exchange ratio formula.

Specifically, at closing, the stockholders of the US drugmaker will receive the number of shares of Revolution Medicines common stock equal to the sum of 7,692,308 Revolution Medicines shares. They will also get additional shares equal to $870m.

EQRx president and CEO Melanie Nallicheri said: “Today’s announcement is a result of a rigorous process run by an independent committee of directors of the EQRx board that thoroughly explored and considered strategic alternatives to maximise value to EQRx stockholders.”

The deal is anticipated to close in November this year, subject to the fulfilment of customary closing conditions, such as regulatory review and approval by Revolution’s and EQRx’s investors.