The transaction also includes a strategic partnership to jointly develop and market Cullinan Oncology’s lead programme, CLN-081/TAS6417, an orally available, differentiated, irreversible inhibitor of epidermal growth factor receptor (EGFR)

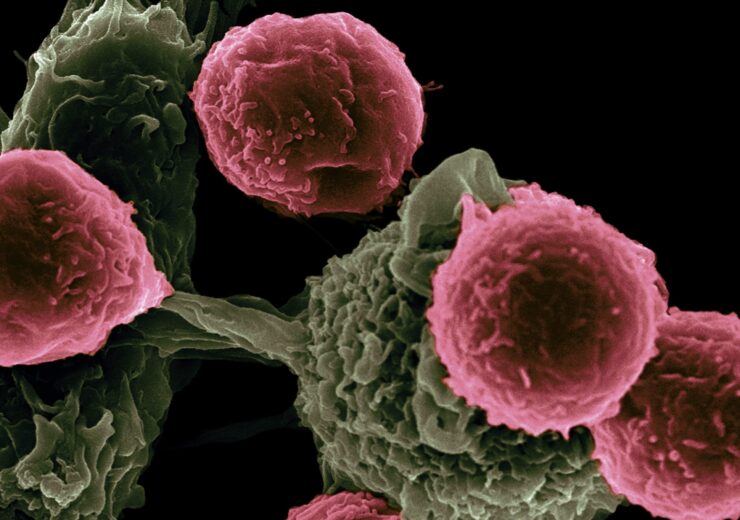

Taiho Pharmaceutical agrees to acquire Cullinan Pearl. (Credit: National Cancer Institute on Unsplash)

Japan-based Taiho Pharmaceutical has acquired to acquire Cullinan Pearl, a subsidiary of Cullinan Oncology, for up to $405m.

The transaction also includes a strategic partnership to jointly develop and market Cullinan Oncology’s lead programme, CLN-081/TAS6417, an orally available, differentiated, irreversible inhibitor of epidermal growth factor receptor (EGFR).

CLN-081/TAS6417 targets cells expressing EGFR exon 20 insertion mutations without impacting wild-type EGFR-expressing cells.

It is a clinical candidate to treat EGFR exon 20 non-small cell lung cancer (NSCLC).

Cullinan Pearl, which was formed by Taiho, its subsidiaries and Cullinan Oncology, holds global rights to CLN-081/TAS6417, excluding Japan.

Under the agreement, Cullinan Oncology is entitled to receive $275m in upfront cash payment on Taiho acquiring Cullinan Pearl.

Cullinan Oncology will also receive up to $130m upon achieving EGFR exon 20 NSCLC regulatory milestones.

As part of the deal, Taiho and Cullinan Oncology will develop CLN-081/TAS6417 while Cullinan Oncology will hold an option for jointly marketing the therapy in the US together with Taiho Oncology.

Taiho will cover the marketing of CLN-081/TAS6417 in territories outside the US and China.

Cullinan Oncology and Taiho will equally fund CLN-081/TAS6417’s future clinical development in the US and equally share the profits from potential product sales in the region.

They aim to begin a pivotal clinical trial of the therapy in the second half of this year.

Taiho Pharmaceutical president and representative director Masayuki Kobayashi said: “Cullinan Oncology has carried CLN-081/TAS6417 from pre-IND to planned pivotal study in approximately three years.

“Utilising Cullinan Oncology’s unique business model through this strategic collaboration, we aim to hasten and maximise the development of CLN-081/TAS6417.”

The acquisition is expected to conclude in the second quarter of this year, subject to necessary closing conditions.